Gender discrimination is an enduring issue that pervades various sectors, including insurance. Although many countries have made significant strides toward eliminating gender inequality, the insurance industry still displays a number of biases that disproportionately affect individuals based on their gender. Insurance is fundamentally about assessing and managing risk, but when gender becomes a primary factor in this process, it often results in inequitable treatment. Gender discrimination in insurance manifests in various ways, from pricing models to coverage restrictions and claim settlements.

This article delves into the different manifestations of gender discrimination in insurance, examining how it affects life insurance, health insurance, car insurance, and retirement planning. We will also discuss regulatory frameworks, the challenges of eradicating these biases, and the evolving landscape of gender equality in the insurance industry.

1. Understanding Gender Discrimination in Insurance

Gender discrimination in insurance refers to any practice or policy that results in unequal treatment of individuals based on their gender, leading to disadvantages for one gender compared to the other. Historically, the insurance industry has used gender as one of the key metrics in risk assessment, which in turn influences premium rates and coverage options. While some of these practices are justified by actuarial data, they can perpetuate stereotypes and reinforce inequality.

Direct vs. Indirect Gender Discrimination

- Direct Discrimination: This occurs when an individual is treated less favorably explicitly because of their gender. For instance, charging higher premiums to women for the same insurance coverage as men would be an example of direct discrimination.

- Indirect Discrimination: This happens when a seemingly neutral policy disproportionately affects one gender. For example, a health insurance policy that excludes maternity care might not seem gender-specific but effectively discriminates against women by failing to cover a vital aspect of their healthcare needs.

Both forms of discrimination are prevalent in various types of insurance policies and can have long-lasting financial and social implications.

2. Manifestations in Life Insurance

Life insurance is one area where gender has historically played a significant role in determining premiums and coverage levels. Traditionally, women were charged lower premiums than men because, statistically, women tend to live longer. While this may seem like a favorable bias toward women, it has its drawbacks.

Gender-Based Pricing Models

For many years, life insurance premiums were calculated based on the assumption that women posed a lower risk to insurers due to their longer life expectancy. As a result, men often paid higher premiums for the same coverage. However, this approach overlooks the financial challenges women face, such as the gender pay gap, career breaks for caregiving, and longer retirement periods due to longevity.

Moreover, these pricing models fail to account for the fact that gender is not the only factor that determines an individual’s risk profile. Health conditions, lifestyle choices, and family history play equally important roles. Some regulatory frameworks have begun to address these discrepancies by banning gender-based pricing models, as seen in the European Union with the Gender Directive, which prohibits gender as a factor in insurance pricing.

Access to Coverage

In some regions, women have historically faced challenges in accessing life insurance due to societal roles. For instance, women who were homemakers or part-time workers were sometimes considered “uninsurable” or were offered lower coverage amounts. This form of discrimination reflects the broader economic disadvantages women have faced over time and continues to influence their ability to secure adequate life insurance.

3. Health Insurance and Gender Biases

Health insurance is another sector where gender discrimination manifests in various ways. Women, in particular, have been subject to higher premiums, exclusions, and coverage restrictions based on their gender and specific healthcare needs.

Higher Premiums for Women

In the past, women were often charged higher premiums for health insurance compared to men. This was largely due to the assumption that women would incur higher healthcare costs, particularly related to reproductive health, maternity care, and chronic conditions that tend to affect women more frequently, such as autoimmune diseases. For example, in the U.S. before the Affordable Care Act (ACA) was enacted in 2010, it was common for women to pay significantly more for health insurance than men of the same age and health status.

While the ACA banned gender rating in health insurance, other countries still allow insurers to use gender as a factor in premium calculations. This perpetuates the notion that women are inherently more expensive to insure, which reinforces gender-based economic disparities.

Exclusion of Reproductive Health and Maternity Care

Historically, many health insurance policies have excluded or severely limited coverage for maternity care, contraceptives, and other reproductive health services. This exclusion disproportionately affects women, who bear the physical and financial burden of pregnancy, childbirth, and reproductive health issues. In countries where public health systems do not cover these services, women are often forced to pay out-of-pocket, leading to financial strain.

Moreover, policies that exclude coverage for gender-specific health conditions, such as breast cancer or cervical cancer, further disadvantage women. Such exclusions reflect a failure to recognize the unique healthcare needs of different genders and contribute to unequal access to comprehensive healthcare.

4. Car Insurance and Gender-Based Pricing

Car insurance is another area where gender discrimination has historically been prevalent. Insurers often use gender as a key factor in determining auto insurance premiums, with younger men typically facing higher premiums than women of the same age. This practice is based on actuarial data showing that young men are more likely to be involved in accidents than young women.

Young Male Drivers and Higher Premiums

Insurance companies argue that charging higher premiums for young male drivers is justified by their higher risk profile. Statistically, men, especially younger men, tend to engage in riskier driving behaviors, such as speeding and driving under the influence, leading to higher accident rates. However, this approach can be seen as a form of gender discrimination, as it assumes that all young men are high-risk drivers, ignoring individual driving behavior and experience.

In some countries, efforts have been made to eliminate gender-based pricing in car insurance. For example, the EU Gender Directive banned gender as a pricing factor in auto insurance, leading insurers to focus more on driving history, vehicle type, and location rather than the driver’s gender.

Gender-Neutral Risk Factors

There is a growing movement toward using gender-neutral risk factors in car insurance pricing, such as telematics (usage-based insurance). Telematics devices monitor a driver’s behavior, including speed, braking, and mileage, allowing insurers to assess risk based on actual driving performance rather than demographic factors like gender. This shift represents a move toward a more individualized approach to insurance that reduces gender bias.

5. Gender Discrimination in Retirement Planning

Retirement planning is another area where gender discrimination can have significant long-term consequences. Women are often at a disadvantage when it comes to retirement savings due to lower lifetime earnings, career breaks for caregiving, and longer life expectancy. These factors result in women having less savings and smaller pensions compared to men, despite their longer retirement periods.

The Gender Pay Gap

The gender pay gap is a key contributor to the disparity in retirement savings between men and women. On average, women earn less than men throughout their careers, which means they contribute less to retirement savings plans like 401(k)s, pensions, or social security. Lower lifetime earnings also result in smaller employer contributions to retirement accounts, further exacerbating the gap.

Longer Life Expectancy

Women typically live longer than men, which means they need to save more for retirement to cover additional years of living expenses. However, the combination of lower earnings and longer life expectancy creates a double burden for women. Many women outlive their savings, leading to financial insecurity in old age.

Pension Gender Gap

In many countries, women receive lower pension payments than men due to career interruptions for caregiving responsibilities and part-time work. In some cases, pension systems are designed in ways that disadvantage women, such as tying benefits to years of continuous work. Women who take time off to raise children or care for elderly relatives are often penalized in pension calculations, leading to lower payouts in retirement.

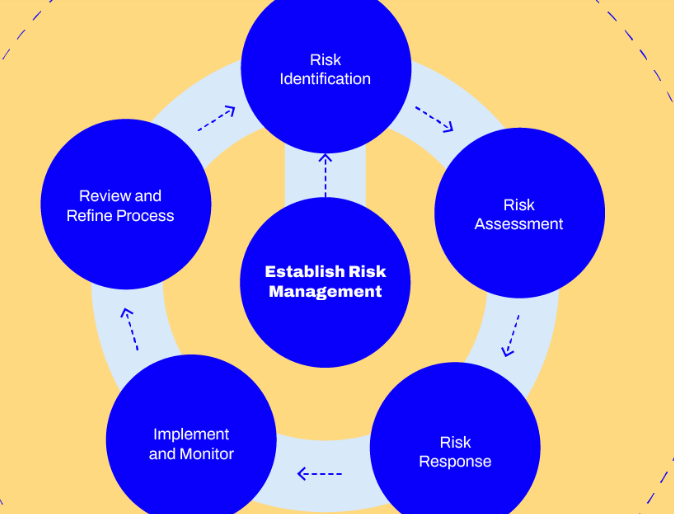

6. Challenges and Regulatory Responses

Addressing gender discrimination in insurance is complex, as insurers often rely on actuarial data that reflect real differences in risk between men and women. However, these data-driven practices can reinforce gender inequality and perpetuate stereotypes. Several regulatory efforts have been made to reduce gender discrimination in insurance, with varying degrees of success.

The European Union Gender Directive

The EU’s Gender Directive, implemented in 2012, was a significant step toward eliminating gender discrimination in insurance. The directive prohibits insurers from using gender as a factor in determining premiums and benefits. While this has led to greater equality in pricing, it has also sparked debates about fairness, as some argue that gender-neutral pricing may result in higher costs for certain groups, such as women seeking life insurance.

The Affordable Care Act (ACA)

In the U.S., the ACA made significant strides in reducing gender discrimination in health insurance. It banned gender rating, meaning insurers could no longer charge women higher premiums than men. It also mandated coverage for maternity care and preventive services like mammograms and contraception. These changes have improved access to affordable healthcare for women, though challenges remain in other areas of insurance.

Ongoing Challenges

Despite regulatory efforts, challenges remain in eliminating gender discrimination in insurance. Actuarial data continue to show differences in risk between genders, and insurers face pressure to balance fairness with profitability. Moreover, indirect discrimination persists in many policies, as certain coverage exclusions or benefit structures disproportionately affect one gender over the other.

Conclusion

Gender discrimination in insurance manifests in various ways across different types of coverage, from life and health insurance to car insurance and retirement planning. While some gender-based pricing models are supported by actuarial data, they can reinforce inequality and limit access to fair and comprehensive coverage. Regulatory efforts such as the EU Gender Directive and the ACA have made progress in addressing these issues, but challenges remain in creating a truly gender-neutral insurance landscape.

As the insurance industry evolves, there is a growing movement toward more individualized risk assessment models, such as telematics in car insurance, which reduce reliance on demographic factors like gender. Moving forward, insurers, regulators, and policymakers must work together to ensure that insurance practices are fair, equitable, and reflective of individuals’ unique risk profiles, rather than perpetuating outdated gender stereotypes.